Were you ever interested in how to budget your money wisely?

Talking about money is actually my favorite topic, because I love money and money loves me. (If you feel like there is something wrong with me, visit Luckybitch.com and get some money mindset clearing) Money is not the root of all evil, it will not make bad things happen to you, it will not make people hate you and it will not turn you into an evil witch.

Money is energy and what it does is amplifying what you already are. Click to Tweet!

If you are a bad person, more money will make you do more bad things and turn you into a worse person, but if you are a good, giving person, more money will only make you be better and help even more people. And yes, it is this simple!

Money does not bring happiness because happiness is not a destination, but a journey.

And if you think money is so bad, then why do you (and everyone else on this planet) want more of it? This is a contradiction of what you want and what you feel is right. This is why only a few people in this world make a lot of money and all the others are just surviving – money blocks.

Money Blocks That Keep You Broke!

Everybody has money blocks because they developed since you were little, and you heard and saw what money can do in life. Maybe your parents fought over money, maybe you never had enough to eat or dress, maybe you never went on a proper vacation or, maybe you saw rich people being greedy and you don’t want to end up greedy – so you don’t want to be rich. There are so many blocks and so many examples, that we can spend days just talking about this particular subject.

My personal money story is that I always had money, but never enjoyed them because I always felt like ‘I cannot afford this‘. So, I would save money, but never buy the things I always wanted. I would buy cheap clothes, cheap beauty products, not go out, eat crappy food, the list goes on. The moment I met my boyfriend, who was the total opposite of me: having not a lot of money, but always buying all the desired things and going out and enjoying life; I knew the way I live my life is not the happy way. But at the same time, enjoying life and having no money did not sound like a better idea either.

The solution: we learned how to budget our money wisely!

After 6 years of relationship, of course, we got to have the same mindset when it comes to money. We now make good money, save a portion and leave some for fun activities. (at the present moment we are in the process of investing in our 3 businesses, so most of the money go into business development, but that does not mean that we cannot go out for dinner occasionally, or buy something we love just because we can)

In order to make more money and attract more abundance in your life you can do many things (I will write a post about it and how I managed to get my business from 0 money to a few thousands) like decluttering your past and changing your money mindset. (and yes, it has a bit to do with luckybitch.com – I love Denise)

But the topic of the day is ‘How to Budget Your Money Wisely‘ and not Money Mindset, so let’s get started and talk about how to budget in a smart and safe way.

Basic Budgeting – #1. Balanced

One of my favorite financial experts is Manisha Thakor (find her at Moneyzen) and her idea of a balanced budgeting is this:

NEEDS: housing, transportation, food, childcare, insurance, and mandatory debt pay-down.

WANTS: the fun things that bring you joy, like going out to dinner, buying a new pair of shoes, set up a massage appointment

SAVINGS: your special account for special occasions. It is said that you should always have $2,000 in your savings account, just in case something happens, or you might encounter a really cool opportunity and you want to invest in.

Next time you get your paycheck, look at the amount, after taxes, and try to divide like this and see if it is doable for you.

Basic Budgeting – #2. Too Many Expenses

Depending on your income and fees, the balanced way of budgeting your money might not be an option for you at this point. Is this how your ratio looks like?

Ideas to help you switch to the balanced basic budgeting

#1. Look at your MUST expenses, where can you cut and why

Some people like buying only the latest gadgets, even if they know they cannot afford it. You are way smarter than that and you know that you buy your things based on how much you need them and why you need them. Maybe you can look for a cheaper apartment, maybe you can take the bus instead of your car, maybe you can cook more and spend less money on take-out or eating out. What are the things you don’t really need, but you pay for them anyway?

#2. Make more money

Everyone would like this one better than anything else. Why? Because we think that by making more, the problem gets solved. The truth is that by making more, you will spend more, not necessarily have more (that’s why we’re talking about budgeting your money wisely!). Always go back to step one and check your NEEDS. In order to make more money you either need to ask for a pay increase, get another part-time job, invest in a business, start a new business, invest in yourself to be able to know more and market yourself better or clear your abundance blocks. You have plenty of options, don’t just sit there and complain, go out there and start with something.

#3. Start saving at least 1%

What is one %? Almost nothing, but by making a habit out of saving, each month, you will actually save more in time. Start small and be consistent, those $10-$20 each month, do count for something!

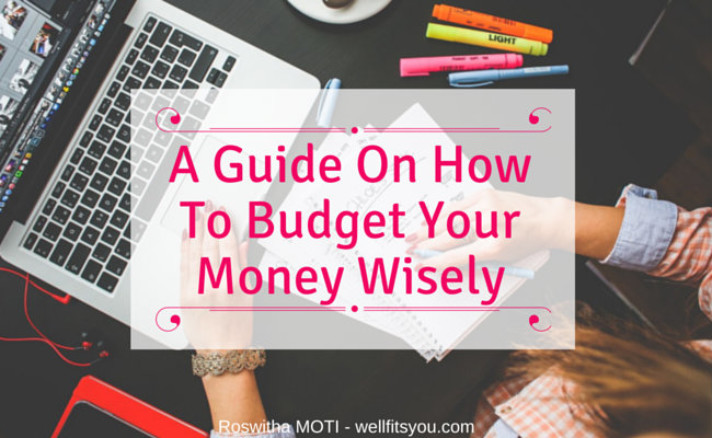

Basic Budgeting – #3. Live Now, Young And Restless

The third kind of ratio when it comes to money budgeting might look like this:

Are you in this category?

If you are, I am sorry to be the one telling you this, but it is time to grow up. Your parents love you and want the best for you, but you are capable of making your own financial decisions and make a living like a normal adult. The occasional money you get from parents, should go into savings or some kind of investment, not paying bills. You are strong, smart, independent and capable of sustaining yourself financially.

How can you start having a better ratio?

- Pay your NEEDS first

- Try not to spend more on WANTS than on NEEDS, because wants will not threw you out on the street, but needs will. Pay attention to this, since is your life and you want to enjoy it a long time, not just now.

- Start saving at least 1%, plus everything you get extra

Basic Budgeting – #4. Suffering Does Not Get You To Heaven

The last category, that I have encountered, has a lot to do with religious beliefs and of course, money blocks. If you see money as evil, or material desires as being evil, you are most likely in this category:

These people don’t allow themselves to enjoy life. They work to pay the bills and save money, not having any joy rather than ‘the normal amount‘. In order for us to be truly happy, we must allow ourselves to buy the things we love and do the things we want.

Just because you save a lot of money and your back account is loaded, but you eat from McDonalds, because organic food is too expensive, will not get you to heaven. People often think that if they suffer and restrict their WANTS, here on earth, God will open the sky and welcome them into heaven like kings, because they ‘suffered enough‘ and had always been ‘good‘.

I believe GOD does not do this, GOD is love and He wants us to enjoy our lives, to be happy, to be content, to love ourselves so much so we can love others. Being resentful of how others spend, or how happy others are because they like ‘material stuff‘ does not make you a saint, in fact, it makes you miserable. Choose to be happy! (cause, you have this choice!)

Conclusion:

What Have You Learned From This Article?

- Money is energy and what it does, is amplifying what you already are.

- Money does not bring happiness because happiness is not a destination, but a journey.

- There is a balanced way of budgeting that will allow you to live a stress-free happy life.

- If you cannot yet afford to budget your money wisely (the balanced way), there are a few ideas to help you get back on track.

Do you know now how to budget your money wisely?

Sources:

-

Manisha Thakor’s Healthy Spending Pyramid www.moneyzen.com

Did you like this article?

Tell me in a comment below and let me know what you think. Also, if you think this article might help any of your friends, please SHARE it – let’s spread the word and make as many people happy, healthy, wealthy and fulfilled!

Leave A Comment

You must be logged in to post a comment.